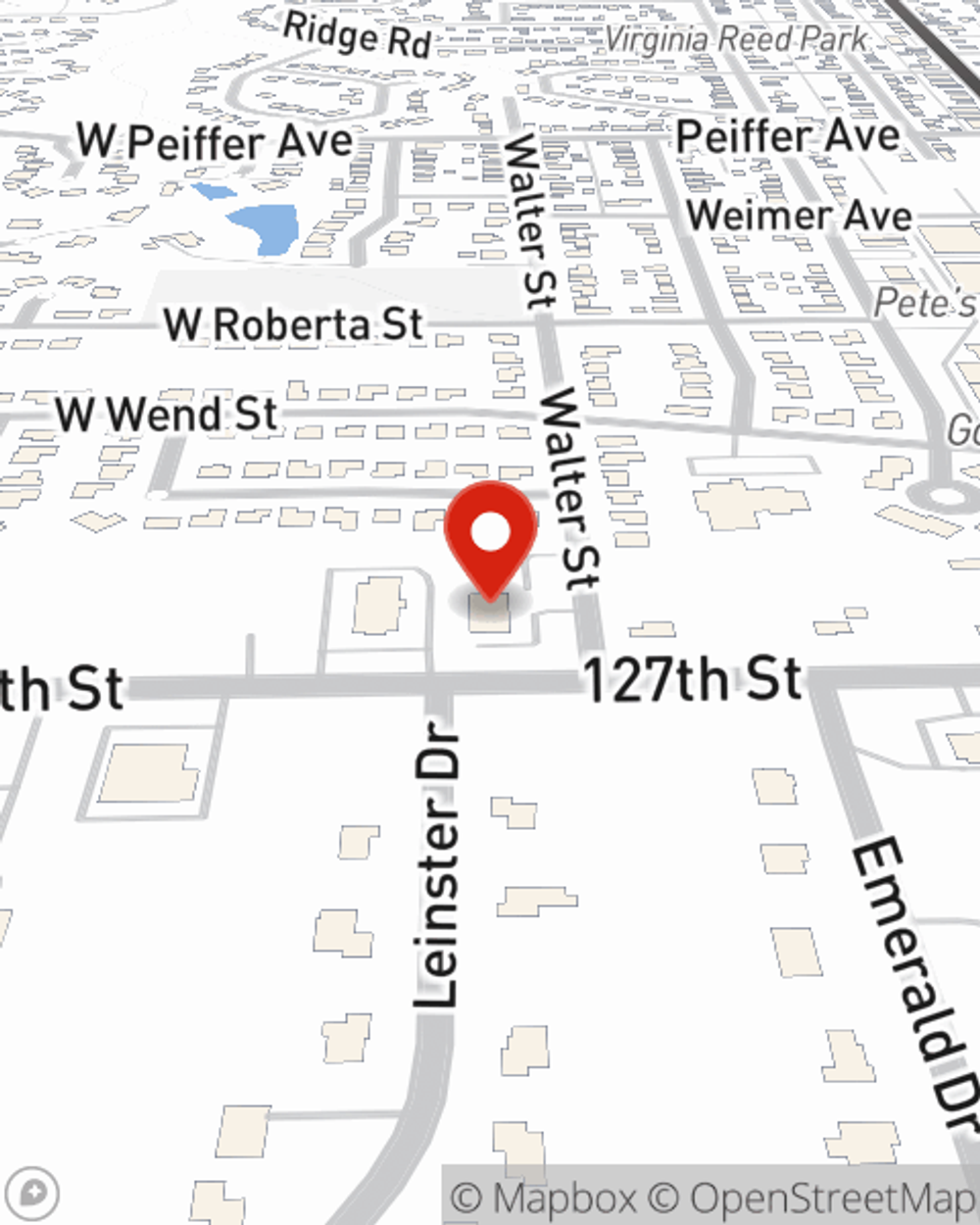

Life Insurance in and around Lemont

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Lemont

- Lockport

- Homer Glen

- Bolingbrook

Your Life Insurance Search Is Over

One of the greatest ways you can protect your family is by taking the steps to be prepared. As uneasy as pondering this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

Protection for those you care about

Now is the right time to think about life insurance

Agent Phil Mormann, At Your Service

Having the right life insurance coverage can help loss be a bit less stressful for those closest to you and give time to recover. It can also help cover important living expenses like rent payments, car payments and grocery bills.

If you're looking for dependable insurance and compassionate service, you're in the right place. Call or email State Farm agent Phil Mormann today to see which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Phil at (630) 257-5414 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Phil Mormann

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.